If you're visiting a parent or family member during the holidays it can be an excellent time to have those critical, and sometimes challenging, conversations.

Being prepared and having some strategies in mind, before you sit down at the kitchen table, can make all the difference when bringing up difficult subjects. While working with seniors and their families over the years, I have picked up a few strategies that have been quite helpful.

Sometimes knowing what not to do can be a great place to start and monitoring your own behavior, before the conversation takes place, can save much frustration for all involved. I found an excellent book entitled, "With All Due Respect...Are Your Aging Parents Driving You Crazy?" by Joseph A. Ilardo, PhD, LCSW and Carole R. Rothman, PhD.

In their book they mentioned three basic errors of the "well-meaning child." I found this section quite helpful, which explained how adult children may:

- "Act prematurely." Taking action too quickly, before understanding the whole picture, can sometimes lead to the wrong solution.

- "Fail to consider their parents' feelings and desires." This may not be done intentionally, but if there are time constraints or the issue is pressing, this very important factor can be overlooked.

- "Do more than is needed." Honoring a parent's independence and right to choose should always be a priority! Focusing on his or her abilities rather than disabilities can help avoid doing too much for your loved one.

Christine Munson, CSA, lives and works in Phoenix, AZ and is a Communications Manager for a retirement community and a Professional Organizer, specializing in senior services. Christie can be contacted at simply-life@cox.net.

Resources: ILardo, Joseph A. and Rothman, Carol R. With All Due Respect...Are Your Aging Parents Driving You Crazy? Acton: VanderWyk & Burnham, 2001

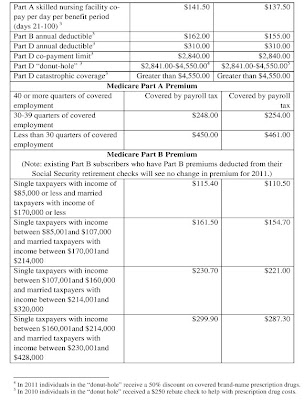

To print a hardcopy of this table, visit

To print a hardcopy of this table, visit